Stamp Duty changes

As part of the chancellor’s Autumn Statement on Wednesday 3rd December some significant changes to Stamp Duty Land Tax – the tax paid on property purchases in the UK – were announced.

Here we look at what was announced, how it affects you and the likely impact these changes will have on the market.

What has changed?

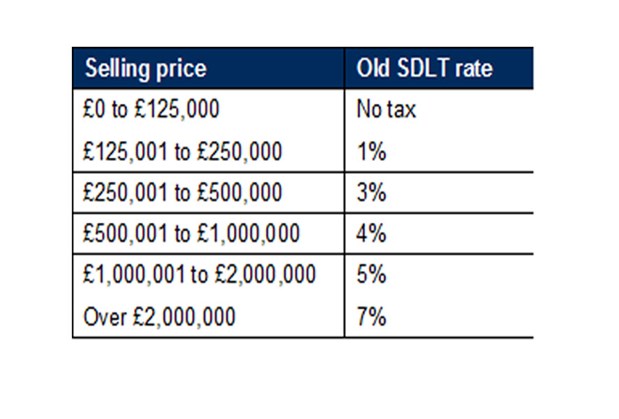

Prior to the Autumn Statement residential property sales were subject to Stamp Duty Land Tax (SDLT) based on the selling price of the property. There were six tax bands as indicated below:

This tax was applied the entire selling price of the property. Following the changes, SDLT is still paid depending on the selling price of the property but the bands themselves are changing and the tax will only be applied to the portion of the selling price over each band.

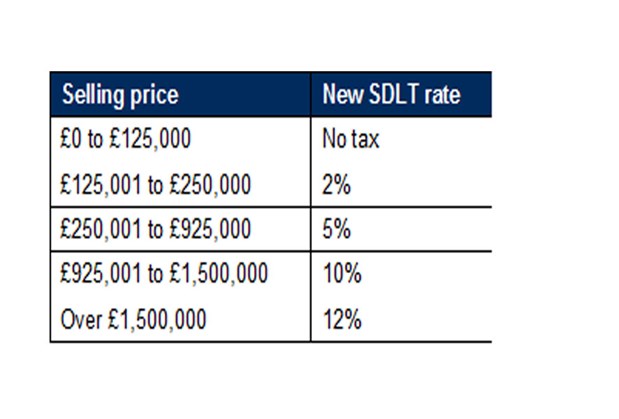

The proposed bands are shown below:

For example, if you’re buying a home for £270,000 you’d have paid £8,100 in Stamp Duty under the old system (3% of £270,000).

Under the new system you would pay 2% on every pound between £125,000 and £250,000 and then 5% on every pound over £250,000.

Total tax paid would thus be:

2% * (250000 – 125000) + 5% * (270000 - 250000) = (0.02*125000) + (0.05*20000) = £3,500

When will these changes take effect?

The new tax bands came into effect as of 4 December 2014.

What happened to the Land & Buildings Transaction Tax announced by the Scottish Government?

The Scottish Government announced in October of this year that SDLT in Scotland will be replaced by Land & Buildings Transaction Tax (LBTT) from April 2015. This is still the case. Until April, the new rate of SDLT will apply in Scotland.

Read more about LBTT and the proposed banding.

What does it mean for me?

- Everyone buying a home for £125,000 or less will be unaffected. No tax was paid on these sales before and that will remain the case.

- If you’re buying for more than £125,000 and less than £937,500 then you’ll pay less tax under the new SDLT system.

- If you’re buying a home for between £937,500 and £1,000,000 you will pay more under the new system of SDLT.

- If you're buying a home for between £1,000,001 and £1,125,000 you will pay less under the new system.

- Everyone buying a home for more than £1,125,000 will pay more under the new system.

Is the difference in tax significant?

In many cases, yes. For example, the average price of a three-bedroom detached house in Edinburgh is £319,131. Previously, the tax paid when buying such a property would have been £9,574. Today that figure stands at £5,957, a saving of £3,617.

Conversely, if you’re buying a home for £1.5million you would have previously paid tax of £75,000. That figure now stands a £93,750.

How does the new system compare to LBTT?

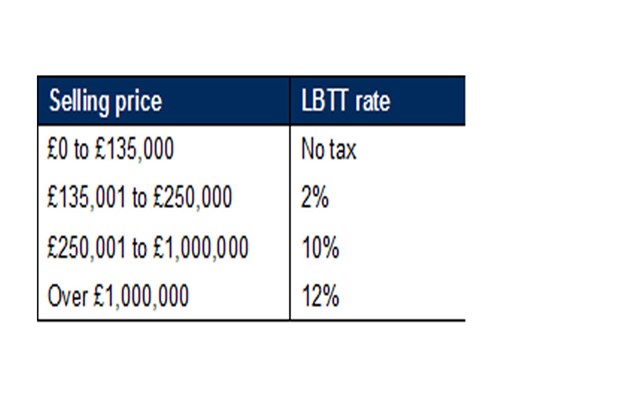

The proposed bands for LBTT – due to be introduced in Scotland in April 2015 - are shown below. As with the new system of SDLT, the rate of tax is only applied to the portion of the selling price above each threshold.

If you’re buying a home for £125,000 or less then you’ll continue to pay no tax when LBTT is introduced. 29.2% of sales across Edinburgh, the Lothians and Fife are for less than £125,000.

If you’re buying a home for between £125,000 and £254,000 then under the proposed LBTT you’d pay less tax than under the new SDLT system.

This saving would be up to £200 for the 47.5% of sales that fall into this price bracket. The remaining 23.3% of sales in the local area above £254,000 will incur a higher tax bill under the proposed LBTT than is now the case with SDLT.

What impact will all of this have on the local market?

As it stands, anyone thinking of buying a home for more than £254,000 will have an incentive to bring their purchase forward to avoid paying more tax under the proposed LBTT system.

This incentive will be large for many buyers as the potential saving could reach several thousand pounds. In the short-term this is likely to lead to an upturn in activity among buyers in this market during the first quarter of 2015.

We’re also likely to see more sellers putting their home on the market to take advantage of this increase in demand.

Although those buying for between £125,000 and £254,000 will pay up to £200 less under LBTT than is currently the case under SDLT, the size of the saving is unlikely to be sufficient to cause many buyers to delay their purchase.

Where can I get more information?

For more information from the ESPC, feel free to give us a call on 0131 624 8000 or email us at marketing@espc.com